Is IG Markets in breach of its AFSL by suspending or terminating the accounts of clients who lodge complaints?

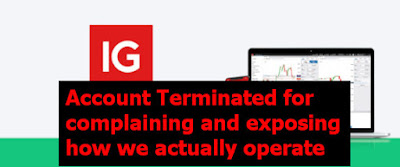

Summary : As detailed in prior posts on CFDs , I complained to the Australian Financial Complaints Authority (AFCA) about the unfair terms of IG Markets automated close-out process for margin calls (30min timeframe even when you're asleep) and that it isn't clearly explained to new clients. Indeed, its fine print actually asserts IG can close your position out instantaneously with the equivalent of a 1.25% adverse price move (75% equity on 20 to 1 leverage) and no margin call notification whatsoever! IG suspended my account after I lodged my AFCA complaint and published my first blog post about it. The AFCA Ombudsman found they were not entitled to do so and it was likely in breach of their AFSL licence conditions. They required IG to pay me $500 for this unjustified suspension. Despite receiving this verdict, IG Markets then terminated my account! (Presumably thinking it was now safe from further scrutiny as the Ombudsman had finalised their decision.) I have accepted IG Marke...